When buying a home, the buyer typically pays loan fees (around 2% to 5% of the home purchase price), and the seller pays the agents’ commission plus various expenses relating to the transfer of property. Is it always this way? Is there any room for negotiation? Depending on your local real estate market, you may be able to score a better deal at closing. Let’s take a look at what seller concessions are and how they work.

What are seller concessions?

Seller concessions are when the seller pays a part of your closing costs. Unfortunately, this does not mean you’ll receive those funds in cash or as a discount on your loan. Instead, the seller offers to pay a certain amount by raising the cost of the home. When bidding on a home, you can offer $350,000 and request $3,000 in concessions to cover some of your closing costs. Just expect the seller to counteroffer with a higher home purchase price of $353,000 (with $3,000 in concessions).

Seller concession vs. price reduction

Keep in mind, these are not interchangeable. While a seller concession might provide short-term relief for a buyer at closing, they're ultimately responsible for a larger loan amount. Price reduction, on the other hand, refers to a seller lowering the price of their residence.

What fees can a seller pay?

Depending on your loan type and down payment, seller concessions may be used for expenses that accompany the processing and securing of your loan*, such as:

*as long as the loan is financing a primary home as opposed to an investment home or second property. Tip: When you find a property you want to make an offer on you must include the seller's concession in the sales contract for it to be valid.

Can repairs be covered?

Most real estate sales contracts contain a home inspection contingency that illustrates the buyer's and the seller's options should problems be discovered during the home inspection. If a home inspection reveals that expensive repairs are necessary, a seller may offer a concession to offset potential or known repair costs. The seller can also provide a reduction in the sales price, or they can choose to leave the repairs up to the buyer. Depending on repair cost, the sales contract, and the loan contingency, doing nothing could result in losing the deal and having to put the home back on the market. Did you know: once an inspection uncovers an issue, the seller must disclose it to all future potential buyers. Consider staging your home to increase it's interior appeal.

Rules and limits by loan program

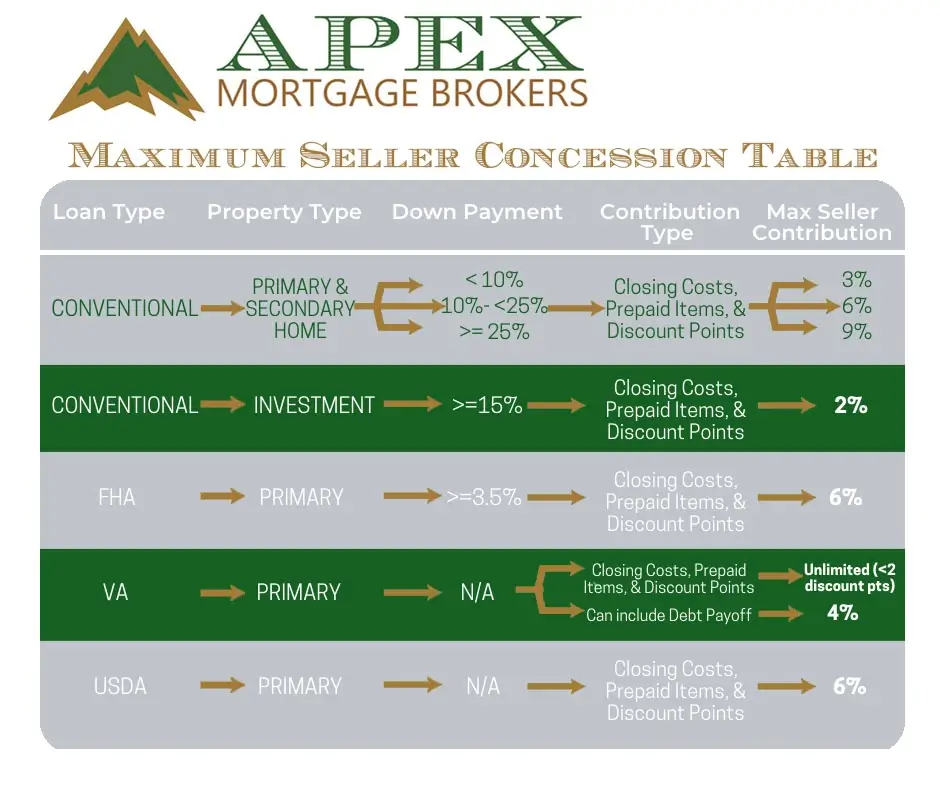

The amount a seller can offer is dependent on the buyer’s loan program.

FHA

The FHA oversees seller concessions to ensure the transaction is fair to both parties. Sellers cannot assist the buyer with the down payment but may be able to help cover closing costs such as:

The FHA limits seller concessions to 6% of the loan amount. Should your concessions exceed 6%, it will result in a dollar-for-dollar reduction to your home loan purchase price. Consider this example: Say you’re financing a $350,000 home. You’re able to use $21,000 in seller concessions — if the seller agrees to assist you. If you’re given (and use) $24,000, your loan amount will cut back to $347,000. Conventional Fannie Mae and Freddie Mac set the rules for conventional loans, which have a maximum cap based on home price and down payment. When financing a primary home, the rules are as follows:

VA

VA loan programs will limit up to a 4% seller's concession towards a buyer’s closing costs. Types of VA seller concessions may include, but are not limited to:

Buyer’s markets vs. seller’s markets

Seller concessions can be used in both buyer’s markets and seller’s markets, although they’re more likely to be granted in buyer’s markets. In a seller’s market, a buyer who requests a seller concession might lose the home they want to another person who’s willing to put more money on the table.

However, in a seller’s market with high demand or low inventory, the seller holds all the cards. If you’re in a seller’s market, you could risk having your offer declined. Learn more tips in our who pays closing costs on a home mortgage article.

Disadvantages

As mentioned earlier, closing costs are usually rolled into a buyer’s home loan when there’s a seller concession, making the loan amount higher. With a 3% concession, a $350,000 mortgage would rise to $360,500. So your monthly payments would go up by $55 a month (assuming a 30-yr fixed-rate mortgage at a 4.75% interest rate). You would also be paying $9,218 more in interest over the life of your loan. Depending on your financial circumstances, avoiding the concession might be the better move. Guide: What to know about For Sale by Owner (FBSO)

Lender credits

Closing costs can come in higher than your offered concession. If seller concessions do not cover all of your closing costs — and you’re still in need of financial assistance — you may be able to request a lender credit, though it will likely result in a higher interest rate. So, you'll pay less upfront, but you pay more over time with a higher interest rate.

The bottom line

The best way to decide whether or not seller concessions are right for you: ask your real estate agent! Your real estate agent understands your local market and has experience in home negotiations (including closing costs), so you can feel confident you're making the best offer to the seller.